Unlocking Southeast Asia's Power Resilience: Tailored Industrial and Commercial Energy Storage Solutions

Ⅰ. Southeast Asia Market Background and Demand Analysis

- Core Driving Factors

- Energy Gap & High Electricity Prices: Southeast Asia's electricity demand is growing at 6% annually (global average 2.8%), but power grids are weak with frequent outages (e.g., Vietnam's industrial zones suffer over USD 3 billion in annual losses). Electricity prices in some areas reach USD 0.19/kWh (Philippines).

- Policy-Mandated Storage: Philippines requires new PV projects above 5MW to integrate 15% storage starting 2025; Vietnam targets 2.7GW of energy storage capacity by 2030; Malaysia allocated 50 million ringgit to promote rooftop PV + storage for government buildings.

- Island Off-Grid Essential Needs: Over half of Indonesia's islands rely on diesel power (cost: USD 0.25/kWh), creating urgent demand for PV+storage replacement.

- Application Scenario Pain Points

- Commercial & Industrial Users: Demand charge management, peak-valley arbitrage, backup power (e.g., Bangladeshi garment parks relying on diesel gensets due to outages; Tuobang storage solution saves RMB 1.6 million annually).

- Off-Grid/Microgrids: Islands, mining areas, and other grid-uncovered regions require independent power systems (e.g., Jinko Energy Storage's 10MWh project reduces diesel consumption by 90%).

II. System Architecture Design

- Technology Selection & Configuration

|

Component |

Solution Description |

Regional Adaptability |

|

Battery System |

Liquid-cooled LiFePO4 (LFP) solution (e.g., Sungrow PowerTitan, Jinko G2 Blue Whale system) |

High temp & humidity environments (Jinko temp control ±2.5°C); >94% round-trip efficiency; >6,000-cycle lifespan. |

|

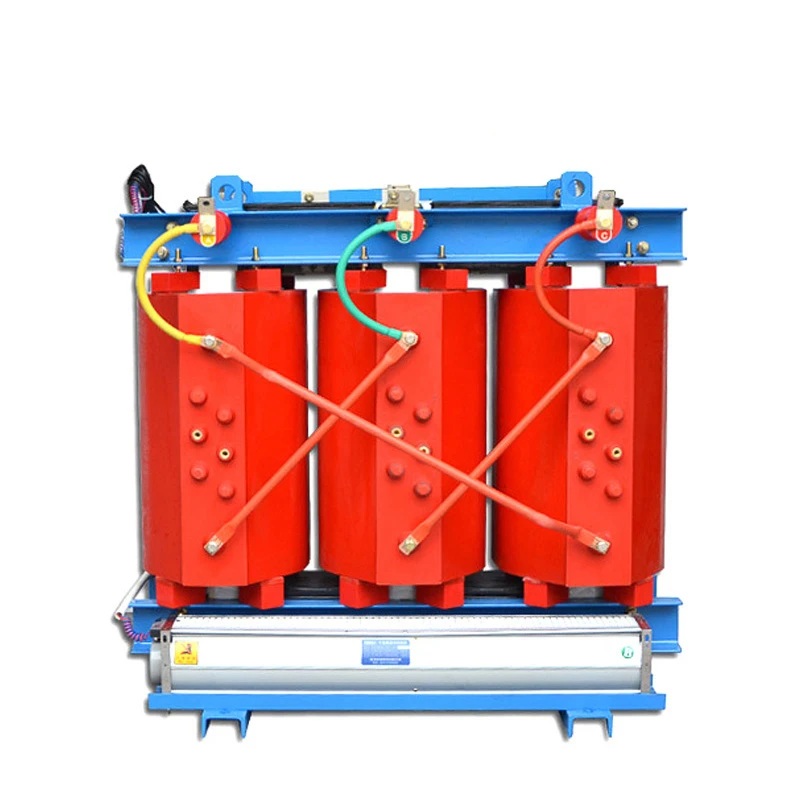

PCS & Grid Integration |

Supports dual off-grid/grid-tied modes; Black start & VSG (Virtual Synchronous Generator) functionality. |

Mitigates grid fluctuations; Cost-saving 0.4kV multi-point grid connection (<1000kW) or 10kV step-up connection (>1000kW). |

|

Energy Management |

Smart EMS platform integrating electricity price forecasting, load dispatch, and VPP (Virtual Power Plant) participation. |

Supports market mechanisms like the Philippines' GEAP bidding, Singapore's Jurong Island electricity futures trading. |

- Typical System Solutions

- Grid-Tied PV + Storage System:

o Capacity: PV with 10%-20% storage capacity (2-4 hours), e.g., 1MW PV + 200kWh/400kWh storage.

o Revenue Models: Peak-valley arbitrage (Southeast Asia peak-to-valley price ratio ~3:1), demand control (reduces transformer capacity fees). - Off-Grid Microgrid System:

o Design: Hybrid power supply (Diesel generator + PV + Storage).

o Applications: Island resorts, mines, factories.

III. Core Advantages & Innovations

- Localized Adaptive Design

- Climate Protection: IP65 rating + liquid-cooled thermal management.

- Compliance: Meets IEC TS 62933-3-3:2022 standard for energy-intensive applications; Compatible with Vietnam/Thailand grid codes (avoids 15-20% retrofitting costs).

- Economic Optimization

|

Cost Item |

Traditional Approach |

Our Solution Optimization |

|

Initial Investment |

High (tariffs + transportation) |

Local manufacturing setup |

|

O&M Cost |

Diesel gen. cost USD 0.25/kWh |

PV+storage LCOE USD 0.08-0.12/kWh |

|

Policy Benefits |

— |

Philippines CIT exemption first 10y, halved next 5y |

- Intelligent O&M & Safety

- Cloud platform monitoring (e.g., Jinko Energy Storage Big Data Platform) enables remote diagnostics and AI fault prediction.

- Multi-level fire isolation + BMS/AIM-D100 insulation monitoring, meeting AS9100D aerospace safety standards.

IV. Project Implementation Path

- Feasibility Study (1-3 Months): Land suitability (industrial land preferred), solar irradiance data (annual generation: 1.3-1.5 million kWh per 1MW).

- Financing & EPC:

o Financing Materials: Feasibility Report (IRR >12%), PPA Agreement, Land Use Permit.

o EPC Requirements: Provide grid connection point parameters, meteorological data, construction timeline penalty clauses. - Deployment & Grid Connection:

o Construction Period: 6-9 months.

V. Cooperation Ecosystem

- Local Partnerships

- Joint Ventures with local enterprises.

- Technical Support

- Offer cost-effective products adapted to the fragmented demand structure of small-medium orders.